Originally published on 8.9.24 with OpenSecrets

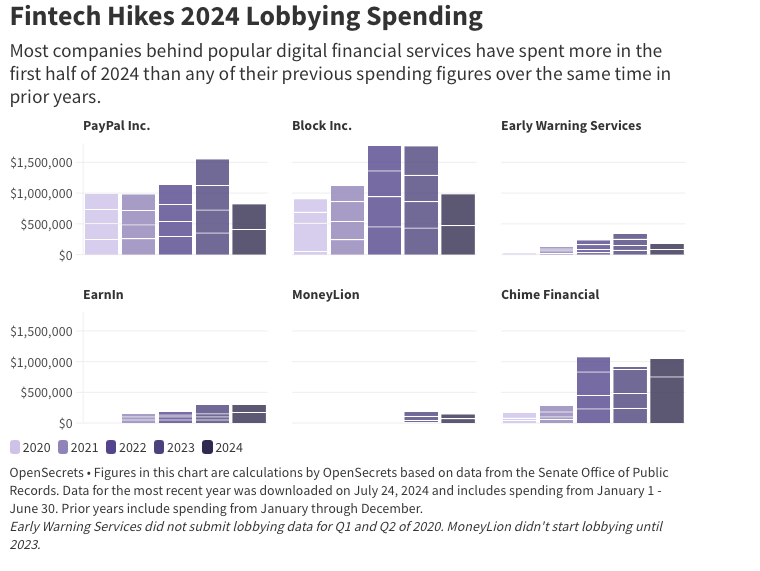

Many companies in the fintech space set new lobbying records in the first two quarters of 2024. From peer-to-peer money transfer apps — apps that let users borrow from their next paycheck — to “neobanks,” lobbying spending is up, and details on why are scant.

Peer-to-peer payment platforms

Peer-to-peer payment giant PayPal Inc., the owner of both PayPal and Venmo, spent over $800,000 on lobbying in the first half of 2024, outpacing its spending during the same timeframe of every prior year.

This trend continues with the company behind CashApp, Block Inc.. Block has PayPal beat, spending just shy of $1 million on lobbying in the first half of 2024, its biggest six-month spend to date. Forbes found in a 2022 year-end survey with OnePoll that 53% of 18-25 year olds used these person-to-person payment platforms and that 50% of 26-41 year olds also used these services.

Early Warning Services, the company behind Zelle, kept its lobbying spend smaller in the first half of the year. It spent $180,000, also its biggest first six-month spend ever. Early Warning Services has also hit a new record in 2024, employing the most lobbyists they ever have with another six months of reports still to come for the year.

While several of these companies report lobbying on specific pieces of legislation, some are not so clear about these activities. The depth of these reports varies quite a bit from company to company. PayPal, for instance, reported lobbying on nine pieces of legislation, noting work of more than half of its active lobbyists on those disclosures. Others, like Block, only reported certain pieces of legislation under the bills it reportedly lobbies on while also suggesting it lobbied on others through its issue reports.

The peer-to-peer segment of the fintech industry has priorities all over the government.

PayPal primarily lobbied on tax-related issues. Key lobbying targets include the $600 reporting threshold for goods and services transactions and the Tax Relief for American Families and Workers Act, which impacts the child tax credit as well as other areas of the tax code. It also advocated for making the qualified business income deduction from the 2017 Tax Cuts and Jobs Act permanent through the Main Street Tax Certainty Act and on marijuana banking policy.

Leave a comment